is colorado a community property state for tax purposes

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. That means marital property isnt automatically assumed to be.

State Taxation As It Applies To 1031 Exchanges

Its considered a separate property or equitable distribution state.

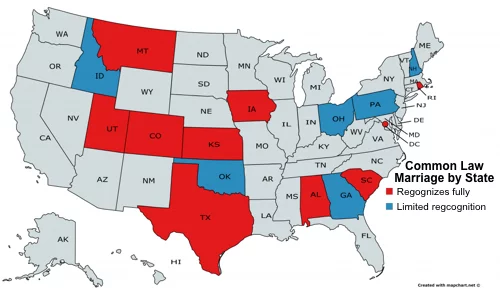

. Personal property declaration schedules for locally assessed. Colorado is an equitable distribution or common law state rather than a community property state. Only nine states in the US.

As many of our readers know Colorado is not a community property state when it comes to divorce. For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income. While fairly easy to determine your filing status when married either joint or separate tax rules get more complicated when you live in a community property state.

Sales tax in Colorado starts at 29 but each county or city can charge more if they want to up to 83 additional tax. First installment of tax bill due. Under your state law earnings of a spouse living separately and apart from the other spouse continue as community property.

Colorado is not a community property state but it does have a category called marital property in colorado most assets acquired during a marriage are considered marital. Is Colorado is a community property state. Yes an individual or married couple if filing jointly must remit Colorado estimated tax payments if their total Colorado tax liability exceeds 1000.

In the case of wagesalary income the. Colorado is a common law state not a community property state which means that each spouse is a separate individual with separate legal and property rights. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Personal property declaration schedules for centrally assessed property are due. That means marital property isnt automatically assumed to be owned by both parties. The nine states that DO have a community.

On your separate returns each of you must report 10000 of. Colorado State Sales Tax. On June 29 2022 the Colorado Department of Revenue Division of Taxation adopted a temporary emergency rule to comply with a state or federal law and the need to set forth the manner in which the prearranged ride fees established in Senate Bill 21-260 which take effect on July 1 2022 are collected May 20 2022.

Instead Colorado courts divide the property of divorcing couples using a method called equitable distribution But what does that mean. The short answer is no Colorado is not a community property state. Based on current state tax rates this means that you may be required to pay up to 112 in taxes on goods and services.

Does it mean equally 5050. Is Colorado a Community Property State for Tax Purposes In some states the conjugal union ends when the spouses separate permanently even if. 5 rows The State of Colorado distinguishes between property and property belonging to the conjugal.

Is Colorado A Community Property State For Tax Purposes The. People often ask. Apply community property laws to what is referred to as the marital estate The marital estate is a term used to describe all of the liabilities and assets.

According to the Federal tax law one spouse cannot itemize and the other will claim the standard deduction even if they are not staying in a community property state. Colorado is an equitable distribution or common law state rather than a community property state. Colorado is an equitable distribution or common law state rather than a community property state.

Thus as a general rule.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property State Turbotax Tax Tips Videos

Community Property States List Vs Common Law Taxes Definition

Using Gifting Between Spouses To Maximize Step Up In Basis

Is Colorado A Community Property State Johnson Law Group

Tax Burden By State 2022 State And Local Taxes Tax Foundation

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

Community Property States List Vs Common Law Taxes Definition

The Beginner S Guide To Capital Gains Tax Infographic Transform Property Consulting Capital Gains Tax Capital Gain Investment Property

States With Highest And Lowest Sales Tax Rates

Thinking About Moving These States Have The Lowest Property Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Using Gifting Between Spouses To Maximize Step Up In Basis

Marital Taxes In Community Property States Community Property Community Marriage Law

States Without Sales Tax Article

Where Are Americans The Happiest Vivid Maps American History Timeline Map America Map

How Do State And Local Sales Taxes Work Tax Policy Center

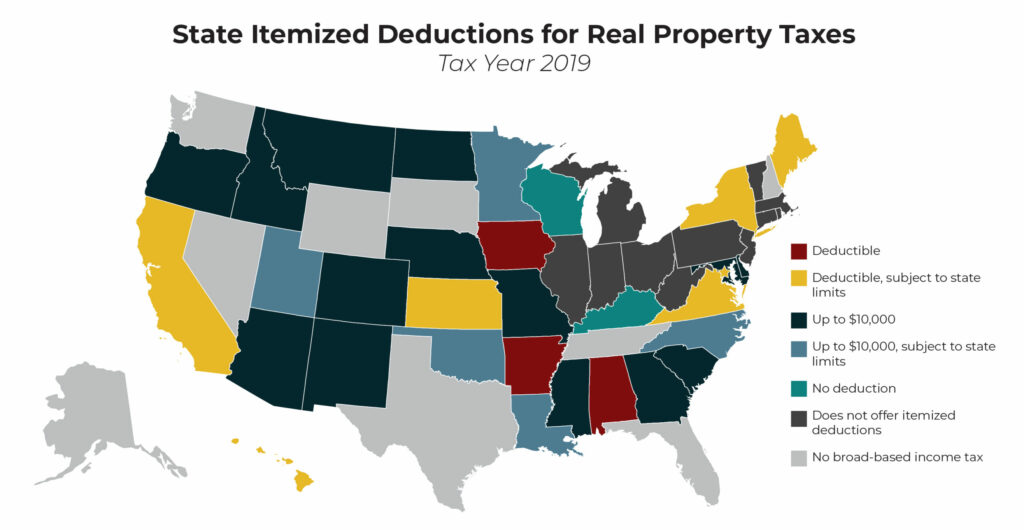

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)